What is the finest disperse: Spending a great deal more having a perfect, move-inside the able house, otherwise to find a property that requires many fascination with a bargain? This is the concern home buyers need certainly to inquire themselves if they are considering to shop for an effective fixer-top. The choice to buy a fixer-higher has a lot of additional baggage, but it is also a great budgeter’s dream throughout the right circumstances. Whenever you are going into the sector and they are within a fork inside the trail anywhere between a move-inside in a position house and you can an excellent fixer-upper family, we recommend carefully evaluating the benefits and you will cons before generally making your own decision. Here are a few of the best factors to thought.

Most apparent, and most very theraputic for your due to the fact a purchaser, is the fact that the you will be able to invest far reduced if you purchase an effective fixer-upper than you’ll to have a move-from inside the ready house. Since homes rates continue ascending within substantial rates, purchasing a move-in able residence is getting increasingly unattainable for many people. This is especially valid having first time consumers having lower than normal budgets. To acquire good fixer-upper lets individuals get a property in the a lower rate. Mainly because services need significant really works, they are shorter valuable and just have less likely to focus the fresh exact same quantity of buyers while the a newly refurbished home. It indicates might deal with faster competition minimizing housing cost to buy a good fixer-top.

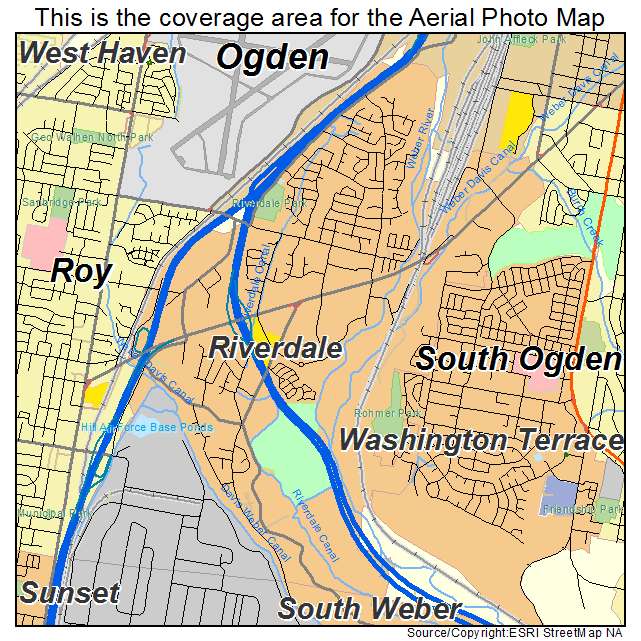

The market are sizzling hot

Regardless of the sort of property you order now, the true house marketplace is scorching and you will aggressive. You will want to consider your reasons for choosing to see if he could be useful right now. Instance, if you’re merely searching for an effective way to earn a lot more money you never you want as a consequence of leasing, then to invest in was an aggravation this is simply not worth it. Even though you are interested in a house to reside yourself, staying in your household otherwise leasing before business cools down is generally wise. It all depends exactly how urgent your circumstances are to pick so it possessions.

Remember that as we pick far more price grows regarding the bank from Canada, our company is attending understand the sector relax a bit and you may rate expands sluggish. This makes consult and you will race ease off as well.

Can cost you of renovating was higher

While you might be able to get an effective fixer-upper having a significantly less speed, it will cost you less to have a conclusion. Attempt to do an abundance of remodeling to make the home liveable, often for you or your tenants. Renovating at the best of the time is a pricey opportunity, although can cost you regarding information have grown gradually much more anyone have picked out so you’re able to renovate along side pandemic, and you may offers was in fact low in index. Remodeling an effective fixer-upper will be very pricey, taking in charges for things like floors, structure, fixtures, and you may standard reputation. Also, you will probably end up being discussing updating the fresh plumbing, power, roofing, or maybe even the origin. Even though you will save you currency upfront if you buy an effective fixer-top, you’ll certainly end up being spending a great deal to look after the actual fixing! You need to carefully believe whether or not might actually finish spending less currency immediately following renovations is out-of-the-way, instead of buying a change-from inside the able house.

Problematic to finance

Another type of challenge of getting a beneficial fixer-higher is protecting the mortgage money for this. Of numerous traditional loan providers does not finance a good fixer-upper. A property assessment will determine the fresh new property’s value, that is going to be a lot below you intend to make it just after renovations. Although not, very loan providers would not give home financing for more than the fresh new home’s appraised worth, and is a challenge. Personal loan providers are more flexible and a lot more going to fund a beneficial mortgage having good fixer-higher. However, they arrive that have higher rates try to ready yourself getting.

Before choosing buying an excellent fixer-top, it’s imperative to see the advantages and disadvantages of this disperse. This is exactly a big partnership that really needs a lot of envision, thus do not hurry throughout your choice! If you need a little extra suggestions deciding on the best selection for your, please get in touch with a large financial company. We are able to walk you through the process and just how this may work at your money and funds.

For those who have small dollar loans any queries in the to invest in a property, give us a call in the Centum Family Loan providers! You can reach all of us in the 506-854-6847, otherwise contact us here.