This service of one’s federal government handles the program and you may sets the minimum conditions having Virtual assistant finance

- No cash reserves required Compared to extremely antique home loan apps, Virginia’s FHA financial is an extremely appealing selection for very first-date property owners that have little financial offers.

- Virginia first time customers need to learn what to anticipate ahead of doing brand new FHA mortgage application process. Are wishing will always be boost your opportunities to effortlessly get loan home loan approved. Right here i list several measures and some things to consider.

So it department of the national handles the application and kits minimal conditions for Virtual assistant funds

- Debt-to-earnings proportion: Cautious studies must be done up until now. Mortgage brokers disagree on the exact wide variety, however, an economic obligations stream that’s greater than 41 so you’re able to 48% was high risk getting an enthusiastic FHA financing. Needed a couple of years out of persisted work without unexplained getaways within the business history.

- Credit score: Its usually the brief issues that many years their credit. Look at the income source, and you will credit history, together with lease history which could show up on a cards get. Score what you straightened out and work towards a clean listing.

- Fico scores: Now a beneficial FICO rating regarding 600 otherwise best is necessary to own this new FHA loan for almost all loan providers and you may finance companies. People that have a greater advance payment of five%+ can be approved which have even lower scores. For those who have had a bankruptcy proceeding or foreclosures, you will need to keeps managed the best credit rating since then (4 decades and you may five years correspondingly) no matter present credit history.

So it agency of one’s federal government manages the application and you may establishes the minimum requirements getting Va finance

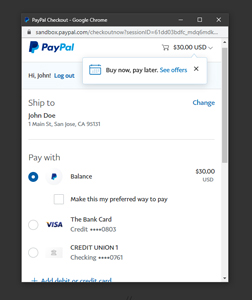

- Fill in the details setting towards the top of this site and you will inform us what you would like. It can allow the FHA home loan elite to call you to definitely explore the majority of your purpose. Next, an entire mortgage application must be done you to definitely information about you, brand new borrower, which is used getting determining cash loan usa Piedmont Alabama whether you’re eligible for a beneficial home mortgage or else. The interest rate and you will terms of the borrowed funds will additionally be recognized mainly of the study on the application for the loan form, fico scores, etcetera.

- When your software is pre-recognized, you can aquire brand new revelation details which might be basically initially mortgage data files which have every piece of information to the words and you will requirements, loan rates, prices and you may home loan repayments of mortgage.

- It’s got become decided and came back including data such as your savings account comments, IDs, the grapevine, etcetera., having validation motives. Constantly, these types of files is prepped and readied through to the loan application is submitted to the borrowed funds underwriter.

- The newest processor twice inspections most of the verifying records that can consult missing documentation in the debtor when needed.

FHA also provides the brand new HUD $100 off program for get a hold of Virginia HUD-had services simply. Buyers trying to find to get good HUD-owned home normally learn about the newest HUD $100 down program here.

We suffice Very first time buyers inside the Virginia and you will throughout the U.S. Consumers having issues can be call us, or fill out the new brief pointers demand mode in this article getting short service.

You should fulfill two sets of conditions, in order to be eligible for including financing. Basic, we possess the basic qualifications criteria established because of the You.S. Agency from Veterans Affairs (VA).

Data files you’ll need for Va investment generally speaking through the Certificate from Qualifications (COE), the latest Consistent Domestic Loan application (URLA), lender comments, tax statements and you can W-dos forms, and also the DD Mode 214 getting veterans that leftover the newest military, and many different simple Va data files. If you want assistance acquiring this type of data files, we can let. Only contact us more than seven days per week.