Exactly how much of the earnings is employed right up purchasing monthly obligations money? Our very own personal debt so you can earnings proportion calculator the percentage of the month-to-month personal debt costs for the terrible month-to-month money. This really is a famous proportion used whenever being qualified for a financial loan but it is also very crucial that you you to learn just how affordable the debt are.

Most loan providers suggest your debt-to-money ratio ought not to surpass 43%. We think a proportion out of 31% or faster is exactly what just be economically compliment and you may anything over 43% is actually factor in concern. If you are up against a proportion out-of 50% or more, you have to know conversing with a financial obligation expert concerning your debt relief selection.

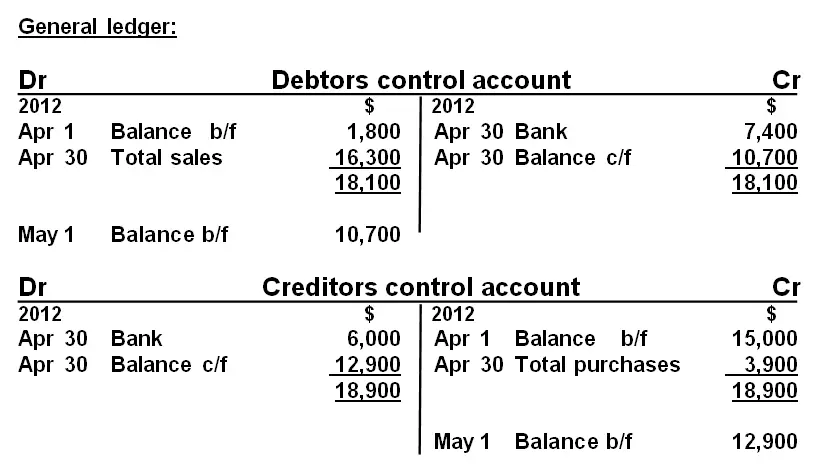

Debt Proportion:

30% otherwise shorter: A great. You are probably Okay. Debt payment isnt drinking too much their month-to-month pay, causing you to be area to improve your repayments enough to repay the money you owe yourself. Build your funds, manage a payment bundle, stick with one plan and you will bad credit personal loans in North Dakota likely end from inside the much better contour in this a year.

31-42%: Down. Although you may be able to do with an obligations payment ratio this large, you are from the limitation listing of appropriate. In the event the a significant number of your own expenses enjoys varying rate focus (instance credit lines) begin working to attenuate the debt today as ascending interest levels would mean a lot more of your own paycheque is heading with the loans fees later. When you are merely and come up with minimal money, the following month keep your costs a comparable. Which have a high, fixed, payment, will help you to escape personal debt sooner or later.

43-49%: Cause for Question. One type in income or desire is also place you about risk region. For people who only provided minimum repayments, you may not have sufficient area on the money to improve your payments enough to pay off your own low-home loan expenses. We help many people having costs within range make a good effective proposal for limited cost to their loan providers.

50% or maybe more: Dangerous. In the event that financial obligation fees are taking on over 50% of one’s paycheque, you are against a financial obligation drama which you probably are unable to offer that have on your own. It’s time to explore choices for debt forgiveness, to help you lower your payment per month so you can an even more affordable height.

So you can estimate the new show of one’s income ate from the obligations fees, fill out the brand new number inside our effortless-to-use obligations-to-money proportion calculator.

Is all income sources, plus a career earnings, your retirement, service repayments, and government guidelines. If you’re mind-employed, were the terrible organization income web regarding doing work expenditures before taxation and personal professionals.

Book or homeloan payment Credit card money Car repayments Student loan money Lender and other mortgage money Cost loans, rent-to-individual Most other personal debt payments Complete Monthly Financial obligation Money

I were one another rent and you may home loan repayments contained in this calculation. As to the reasons? While the a home loan is a significant component of of numerous mans loans troubles, also to make the ratio equivalent, men and women rather than a mortgage is replacement the monthly lease fee.

You may also should include month-to-month spousal service payments if the this type of debt fill up a serious percentage of your earnings.

Such as for example, if the overall month-to-month money was $2,800 as well as your loans money totaled $step one,200 your personal debt-to-money proportion try:

Knowledge the debt-to-earnings proportion

A minimal loans-to-money proportion (DTI) ensures you can afford your debt your hold. While making an application for a different mortgage, lenders consider your financial obligation-to-earnings proportion as part of the loan recognition procedure at exactly the same time into the credit history.

The kind of loans you carry is also a cause of assessing the fresh reasonableness of the DTI. A premier ratio driven because of the a financial obligation such as for example home financing is actually a lot better than a high ratio on account of big unsecured debt including playing cards or payday loans.

- 30% or less is right

- 31% in order to 42% is actually in balance

- 43% so you can 44% try reason behind matter

- 50% or more are hazardous

You’ll likely enjoys a top loans-to-income ratio on the younger many years, especially if you are living when you look at the a location with high actual property opinions like Toronto or Vancouver. As you means advancing years, you really need to reduce your financial obligation stream, therefore it is affordable when you earn your own straight down fixed retirement income.

Lowering your debt stability

You might alter your obligations-to-income proportion both from the boosting your money otherwise by eliminating their loans. For most people, the first option is maybe not viable; however, men need an intend to get out of debt.

- Build a spending plan and create a financial obligation cost plan

- Consolidate obligations to reduce attention can cost you and you may pay stability eventually

- When you’re suffering from excessive obligations, talk with an authorized financial obligation top-notch on the selection that will help your get rid of obligations ultimately.

To ensure you’re making improvements, recalculate your debt-to-earnings proportion most of the few months. By the enjoying their DTI slide, you are more likely to will always be encouraged to bring it off next.