Rebecca was a self-employed contributor to help https://cashadvancecompass.com/installment-loans-vt/ you Newsweek’s private fund group. An authorized student loan therapist, she has written generally toward student loan loans and higher education. Rebecca also offers secure different most other private finance subject areas, in addition to signature loans, the new housing marketplace and credit. She is purchased enabling somebody see the choice and work out informed conclusion about their money.

Jenni is actually your own finance editor and copywriter. Her favorite subject areas was paying, mortgage loans, a residential property, cost management and you can entrepreneurship. She including computers the brand new Mama’s Currency Map podcast, which will help sit-at-household mothers earn more, save money and you will invest the people.

When this woman is maybe not creating or editing, there are Jenni delivering their family to have hikes along side Wasatch Front side, sewing together with her siblings or overcoming some body at the Scrabble.

Interest rates provides fundamentally started increasing over the past long-time, additionally the newest mortgage cost when you look at the Washington are no exception. Centered on data off Redfin, 30-year fixed mortgage cost in the Arizona mediocre 6.667% Apr, whenever you are 31-year repaired refinance rates for the Washington average seven.442% Apr.

Understanding the rates inside the Arizona can help you examine the options for lenders and determine an informed home loan program for the finances. And conventional mortgage loans, you could imagine an authorities-supported mortgage, such an FHA otherwise Va mortgage, or explore programs to own very first-big date homeowners.

This guide covers many of these software to have potential homebuyers into the the newest Evergreen Condition to help you select the right resource option for your house get.

Our very own research is built to give you an extensive expertise from personal loans products you to definitely work best with your position. So you’re able to regarding decision-and come up with processes, our very own expert members contrast popular preferences and you can potential discomfort facts, including affordability, access to, and you will dependability.

Latest Arizona Mortgage Rates

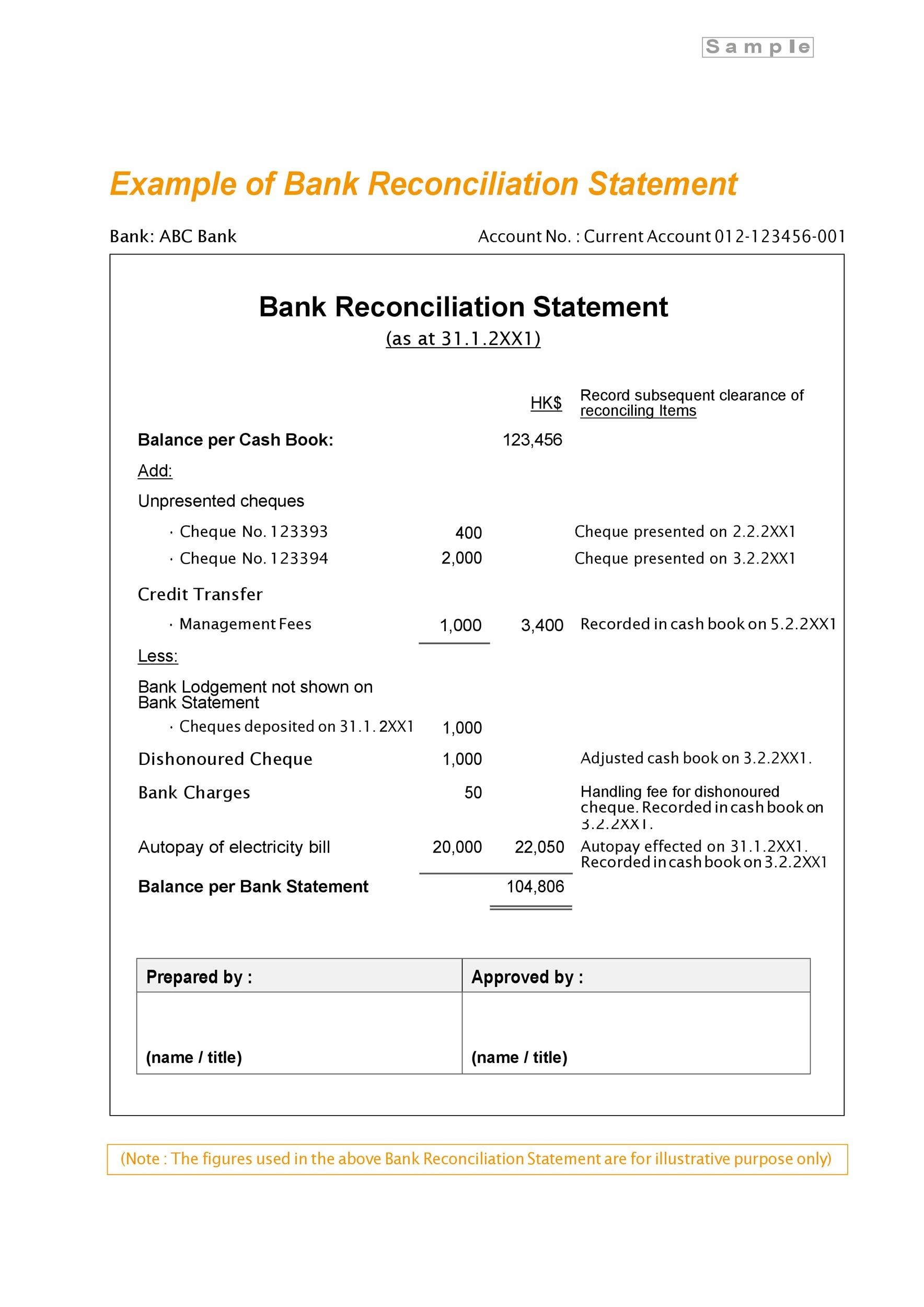

Most recent financial pricing inside Washington average up to 6.6% to possess 15-12 months finance and you will 7.4% getting 30-year finance. The brand new costs on desk below are from Redfin and its financial rates lover, icanbuy, and generally are according to a $320,000 loan.

The fresh averages together with guess a great 20% down-payment and you can a credit rating regarding 740 or higher. The new dining table suggests both rates of interest and you can yearly commission pricing (APRs), which can be a little different steps of borrowing from the bank will cost you.

Interest levels consider focus accrual alone, whereas Annual percentage rate is an even more inclusive identity which will take fees, such as for instance running otherwise document preparation costs, into consideration. Perhaps you have realized, home loan costs will vary dependent on multiple circumstances, for instance the duration of the fresh cost term, types of interest rate (repaired or changeable) and kind of financial, should it be a normal financial, FHA otherwise Va loan.

Refinance mortgage Costs in Arizona

Re-finance cost in Washington is actually somewhat more than the fresh new rates to have family buy finance-and you can more more than the two% to 3% lows in the COVID-19 pandemic. For individuals who currently have a decreased price, refinancing mortgage will most likely not lead you to savings. With ascending home values, regardless if, you might have even more guarantee in order to faucet on your Washington house compared to years earlier.

Vault’s Viewpoint: Washington Financial Rates Trend inside 2024

Its tough to assume the ongoing future of home loan prices, it seems might will still be notably higher than these people were from inside the pandemic throughout the entire year. The Government Set-aside hiked costs several times prior to now couple of age as a way to control rising prices.

The fresh Fed is apparently carrying prices steady for the moment, however, there could be slices till the end of the season, that may end in a decrease in rates certainly lenders nationally and also in the condition of Arizona. But not, brand new Federal Association of Real estate professionals needs pricing to remain between six% and you will 7% throughout 2024.