An alternative vital aspect to consider ‘s the lives off early in the day loans. Brand new Teaspoon bundle allows for a couple of loans at once, and you may the financing can’t be initiated within 60 days away from totally repaying an earlier mortgage.

Lastly, records takes on a life threatening character in the app procedure. Individuals are needed to offer the needed documentation, which might are evidence of a position, a demonstration of one’s suggested accessibility financing (especially for residential loans) and just about every other documentation deemed requisite by the Teaspoon.

When you should Thought a teaspoon Mortgage

Determining when to capture a tsp financing can be good part challenging. Experts tend to recommend against credit out-of later years offers. However, occasionally a tsp financing can make feel, specifically if you find yourself within the a strict location economically. Such financing offer an easy way to access the offers https://paydayloancolorado.net/parker/ without the punishment and you may taxes you’d face for many who only withdrew the bucks downright. Its similar to borrowing funds from oneself, and will become a comforting imagine during undecided moments.

From time to time, problems you’ll pop up that want instantaneous financial appeal. This is often abrupt medical expenses, immediate household solutions or unexpected studies costs. Throughout the such moments, a tsp mortgage can provide you with the required fund swiftly in accordance with fewer difficulties than a timeless bank loan. Part of the mission here’s to handle this new emergency versus derailing your next monetary agreements.

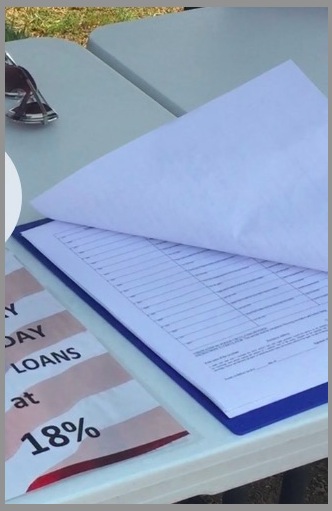

In addition, there is times when you are grappling with a high-attention loans from credit cards or other financing. In these instances, a tsp loan can help you consolidate that it obligations, efficiently decreasing the interest and simplifying the payment plan. By doing this, you can potentially save yourself a large amount of profit the new longer term, while making debt journey much easier much less exhausting. not, its required to means this strategy with caution, making sure that you don’t fall under a pattern of constantly borrowing from the bank up against retirement savings.

But what concerning more pleasant regions of life, including to order another family or investing in further knowledge? Right here also, a teaspoon mortgage may come to your help. It does provide the economic increase wanted to secure property or even to protection degree expenses, assisting to facilitate high life milestones rather than stressful their almost every other monetary tips.

Yet , even after this type of apparently positive scenarios, it is needed so you’re able to consider the selection cautiously. Usually take into account the impact on pension discounts and make certain one to the mortgage does not derail the much time-identity economic wants. An important we have found and then make a proper-informed decision with a definite knowledge of both the advantages and you may prospective disadvantages away from a tsp financing.

The conclusion

Navigating from individuals areas of Teaspoon loans can be 1st hunt a little while overwhelming, but it’s important to know its potential advantages and disadvantages. Delivering that loan against your Thrift Coupons Bundle is largely borrowing from your coming mind, very a proper-thought-aside strategy can go a considerable ways in the securing debt balances from the years into the future.

If your wanting to submit an application for a teaspoon loan, make sure you understand the eligibility criteria as well as the installment plan. Always be aware that the best goal would be to foster a secure and you will comfortable old-age, and every economic choice drawn now would be to fall into line with this particular much time-label mission.

Frequently asked questions On the Tsp Money

It’s possible to have a few fund a great each time out-of their Teaspoon account, among that is a primary house loan. Yet not, it’s important to observe that you cannot pull out an alternative financing within 60 days off repaying an earlier financing entirely.