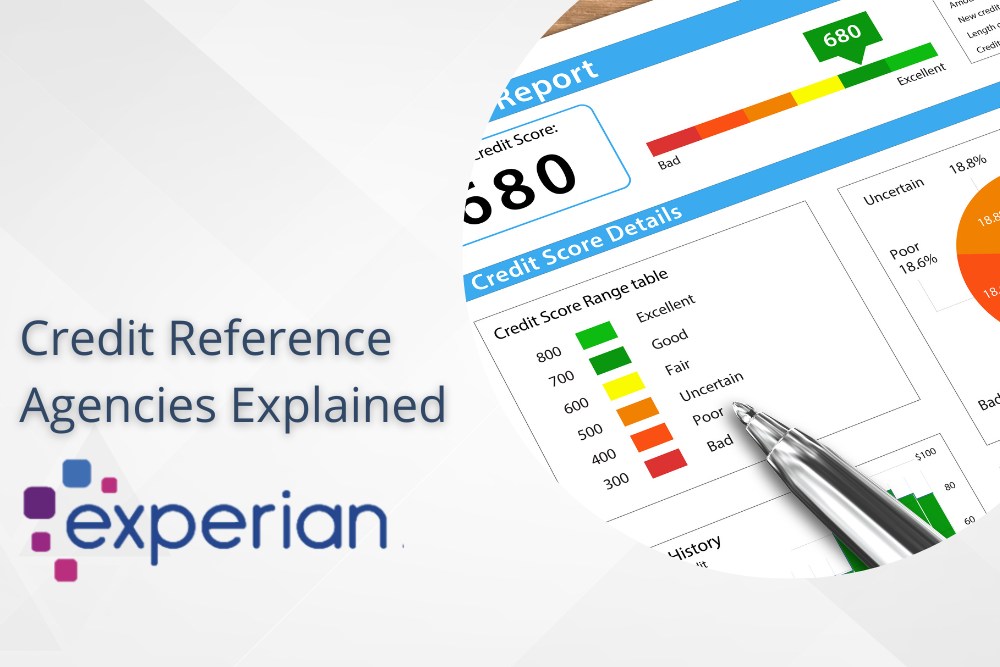

- Reduced credit score? FHA fund ensure it is Credit ratings starting at only 580

- Plenty of financial obligation? FHA features looser requirements to possess qualifying with student loan loans

- Short into the downpayment bucks? The minimum down payment to have FHA is just step 3.5%

- FHA getting first-day buyers

- Great things about FHA

- Disadvantages off FHA

- Exactly how FHA funds really works

- Being qualified that have FHA

- Should you explore FHA?

- FHA loan FAQ

FHA fund for first-time home buyers

FHA funds would be ideal for basic-date homebuyers, whom might not have a lot of money stored otherwise well-centered borrowing. Versatile credit guidelines generate providing an enthusiastic FHA mortgage much easier versus any sort of different kind of financial.

Individuals which have credit scores as low as 580 might get an enthusiastic FHA home loan that have as low as an effective step 3.5% down. Some home buyers could even get approved which have credit scores as reasonable as the five-hundred once they put 10% off.

FHA finance and additionally tend to have lower than-field interest levels versus almost every other mortgage loans. And you may, unlike particular basic-time house customer software, the new FHA mortgage does not have any income limitations. So you’re able to use even though you secure the common otherwise above-average paycheck.

FHA loans have a tendency to work nicely to possess first-time home buyers, but you don’t need to getting a first-date buyer to be considered. The FHA system was available to men.

Repeat customers and property owners seeking to re-finance also are thanks for visiting explore FHA funding – according to the status that they want to reside in our home they are to get otherwise refinancing just like the a first household. FHA funds cannot be useful trips homes otherwise money attributes.

Additionally, unless you’re trying to get a down-payment guidance program otherwise taking your FHA mortgage during your country’s homes fund agencies, you certainly do not need to complete a good homebuyer degree movement.

not, FHA is not necessarily the best choice for everyone. Homeowners that have the lowest deposit but an excellent FICO score will dsicover a traditional loan is less expensive. Additionally, qualified consumers should consider the fresh Virtual assistant mortgage system (to have pros and you will provider members) or perhaps the USDA financing system (getting outlying residents.).

Advantages of FHA fund

There are a number of reason why, immediately following nearly 90 ages, this new FHA mortgage system remains one of the most preferred reduced-down-commission financing on the market.

1. FHA home loan costs are often below-market

FHA payday loans New York home loan prices are typically several.5 foundation facts (0.125%) or higher beneath the rates having a comparable old-fashioned 30-seasons fixed-speed home loan.

Getting finance with down repayments out-of 10% otherwise less, and for individuals which have less-than-prime borrowing from the bank, so it pit is also large. It is not uncommon having basic-date homebuyers, whoever credit scores are usually less than-average, discover an enthusiastic FHA mortgage speed estimate more than 100 base situations (1%) lower than the same conventional rate.

Yet not, its value noting one to FHA’s even more financial insurance fees is also counterbalance the lower rates. Therefore you should evaluate the price of a keen FHA mortgage (home loan advanced incorporated) which have a compliant financing to determine what is the greatest package.

2. You simply you want good step three.5% deposit

FHA loans allow for a downpayment regarding 3.5%, for even customers which have less than-average credit ratings. Other reduced- without-down-commission mortgage loans exist, though most wanted at least average borrowing. The FHA doesn’t have such as limitation.

Concurrently, there are no unique eligibility criteria to own FHA. In contrast, zero-off loans such Va and you can USDA features strict legislation throughout the qualification, area, and/or money constraints.

step three. You don’t need to good credit to be considered

The latest FHA usually insure fund having borrowers having fico scores from five hundred or more. Other mortgage software demand the very least credit history element 620. For homebuyers during the entry level of your own credit scoring range, FHA can be the better path to homeownership.