Guess Their Payment

*Disclaimer: Results obtained from this calculator are designed for relative motives just, and you will reliability isnt guaranteed installment loans online in Colorado. The newest Wilmington Cape Worry Domestic Builders Connection and Cline Legislation Category dont guarantee the precision of every pointers available on it webpages, and they are not accountable for people mistakes, omissions, or misrepresentations.

Home loan Faqs

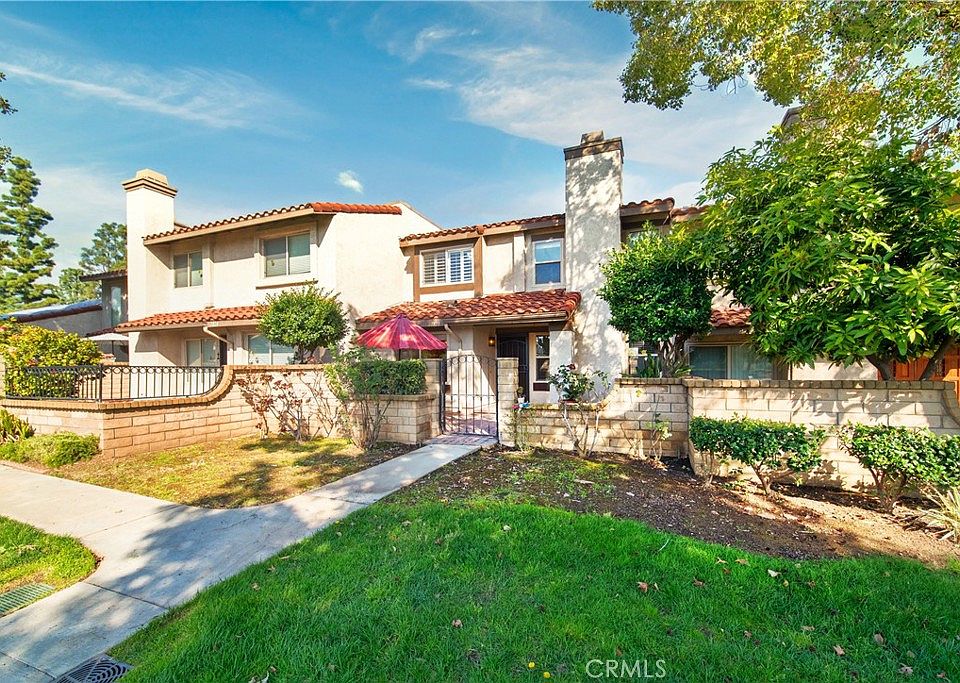

To purchase a new house is a captivating however, tiring procedure. Become proactive and just have your income, possessions, loans and borrowing manageable before you apply.

Go online and then have the 100 % free annual credit file and opinion they your errors otherwise inaccuracies. Dont discover one the brand new borrowing from the bank. Dont sign up for any additional credit cards otherwise car and truck loans.

Gather to one another your documents. You’ll want to offer previous lender comments and you can paycheck stubs. You will you desire their history 24 months of fees.

After you have everything you together, reach out to a loan provider getting a beneficial preapproval. The lender needs the application, work on their borrowing and you will remark the new data you achieved. The financial institution can then tell you just how much away from financing you might qualify for and you may question you an excellent prequalification letter.

This step is important, as numerous family manufacturers won’t opinion now offers out of possible people who aren’t preapproved which have a lender. That have a beneficial preapproval at hand, you might be prepared to begin shopping for the new home!

What is the value in enabling preapproved otherwise prequalified getting an effective home loan?

Taking preapproved by a lender allows you to know precisely exactly how far you might borrow and what budget you might store inside.

When your give on the a special home is recognized, are preapproved will help your order move collectively quicker towards closing because 1 / 2 of the method having mortgage recognition is already complete. The lending company has already analyzed and you may recognized you just like the a debtor; now, most of the they need to do are opinion the home and make sure its qualified.

What selection of cost is always to an initial-big date homebuyer assume with often a poor credit rating or a solid credit history?

In line with the certain chance attributes of circumstances, the interest rate would be large or less than your own neighbor’s. The largest chance basis ‘s the mix of your credit score (known as a good FICO get) therefore the Financing to Really worth (LTV), the portion of new house’s well worth which is mortgaged. A lesser credit score and you may a higher LTV commonly lead to a high rate of interest.

In the 80% LTV, the difference from inside the interest between good 740 credit score and you may an effective 670 credit rating could well be over step 1%.

Property style of may influence rate of interest also. A manufactured house or condo can add on 0.25% toward interest rate more a single house.

What does it suggest when new Given enhances the prices, and exactly how does it connect with mortgage loans?

When the fresh Fed (Government Put aside Lender) enhances the costs; it is for the mention of Government Right-away Price. This is basically the rate that banks charge both to own quick identity borrowing. This can be an element of the latest Perfect Speed,’ hence affects the interest pricing in your handmade cards. Brand new Federal Right away Rates does not in person connect with mortgage rates.

Home loan rates change daily considering way and you can consult during the the financial segments. Improvements on the Federal Immediately Speed can also be signal rising prices (enhancing the rate) otherwise deflation (decreasing the rate) and certainly will be taken just like the a rule that every interest levels would be upgrading or off.

Just what are activities?

Points are a portion of your own loan amount paid back at the closure to attenuate your own interest minimizing your monthly payment.