Will set you back From Refinancing

Before deciding so you can re-finance the mortgage, understanding the pricing on it is vital. Refinancing could easily save some costs finally although not discover upfront expenses to consider:

- Court Costs: You might have to engage good solicitor otherwise conveyancer to deal with the newest legal aspects of your own transaction. Courtroom fees can vary with respect to the complexity of your own refinancing procedure therefore the prices charged by the chose judge associate.

- Valuation Charges: Lenders may require property valuation within the refinancing technique to measure the economy property value your residence. Valuation charge may vary according to property.

- Break Costs: While refinancing from a predetermined-price home loan till the stop of your own repaired identity, you may bear crack costs from your newest bank. This type of charge are made to make up the lending company for your losings interesting earnings through early cost of one’s financing.

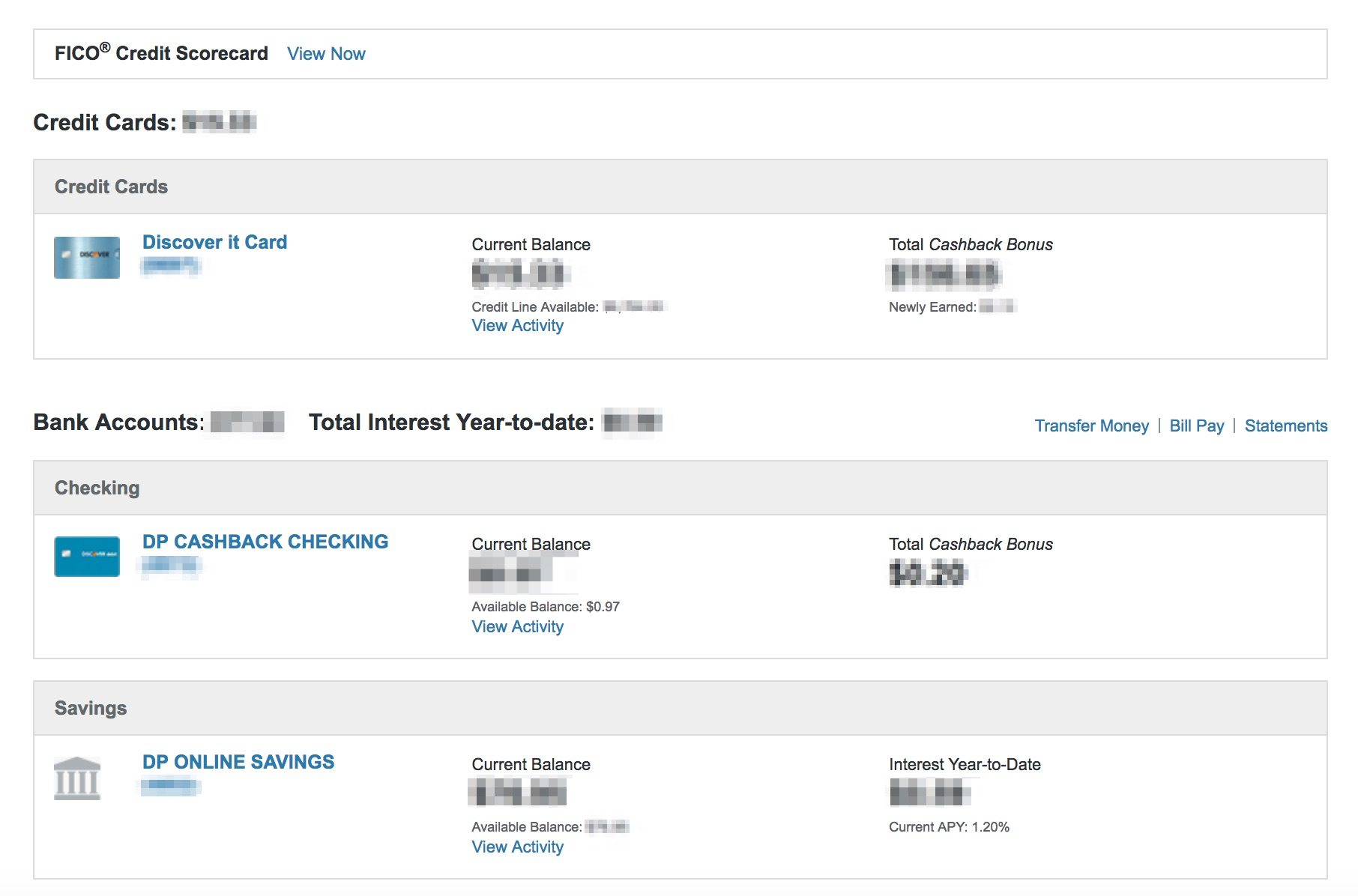

- Cashback fees: For folks who acquired a finances share from the bank whenever paying your loan, you will be compelled to pay so it back when you have perhaps not kept your loan with the agreed several months. Always discover your debt and you may grounds that it in the computations while looking in order to re-finance.

Your brand new lender can provide a profit contribution when paying off your loan, layer a fraction of, otherwise every, of them will cost you.

Anything to take into consideration

In addition to understanding the costs with it, there are some secret considerations to keep in mind whenever refinancing their home loan for the The fresh Zealand:

- Repaired Compared to. Drifting Costs: The latest Zealanders typically go for fixed-price mortgages, providing predictability and stability inside money. Although not, that it has constraints for the flexibility in comparison to floating prices. Consider your exposure threshold and you may coming economic plans whenever choosing ranging from fixed and drifting choice throughout refinancing.

- LVR Constraints and you may Collateral: The Reserve Financial of new Zealand imposes Financing-to-Really worth Ratio (LVR) constraints to suppress threats throughout the housing industry. These types of constraints establish an optimum percentage of this new property’s really worth you to will be borrowed in accordance with the residence’s worth as well as their deposit. Skills your LVR condition and how refinancing might apply to they is a must ahead of continuing.

- Your unique Desires: At some point, the decision to re-finance should align along with your broader financial requirements. Whether you’re seeking to dump monthly installments, availability finance, otherwise arrive at monetary liberty less, refinancing is always to service debt means and you will improve your complete economic well-getting. Contemplate using the online home loan calculatorsto guess potential deals and you may evaluate various other financing choice.

Making an application for Mortgage refinancing

Wanting payday loans Kremmling a trustworthy Agent: When it comes to refinancing, you ought to work on a professional who will help you know mortgage models and what is best suited for your situation. A good NZHL Mortgage Advisor usually direct you through the refinancing processes and help you accomplish your financial goals.

- Meeting records

- Finding the optimum financial fit for your

The key benefits of Expert advice

Navigating the loan financial refinancing process will likely be state-of-the-art and you may every so often challenging. Trying expert advice out of a mortgage broker can provide rewarding recommendations. An agent work as a mediator ranging from you and this new lender, negotiating in your stead so you can keep the most useful loan.

A great NZHL Mortgage Mentor does what you a mortgage broker otherwise agent do, and. Past assisting the mortgage processes, NZHL Mortgage Mentors bring financial training attributes, helping subscribers generate methods to beat attract repayments, create obligations and you will reach economic versatility sooner or later. An effective NZHL Financial Advisor is with your throughout your loan, frequently examining in the to you supply help and guidance with each other ways.