- Financial Stuff

- Problems To end Before you apply Having Financial

Do you know what youre meant to do before taking one step towards making an application for a mortgage check out the home prices, save having a deposit. Those things don’t let yourself be creating, however, try scarcely chatted about.

You can replace your odds of obtaining home you desire by avoiding the newest problems that will reduce the level of financial support you could get, increase the interest rate on your mortgage, or lead a loan provider to help you refute the application.

We are going to enable you to inside the towards half dozen biggest errors our Gurus state you will want to stay away from while you are planning to apply for home financing.

Switching Efforts

A lender has to be assured which you have a constant income and you can incur to cover a home loan payment bill each month. Due to this no less than two years out of constant employment considerably advances the financial app. Simultaneously, your odds of being qualified getting a mortgage are affected when you switch work just before using. Of the things never do prior to preparing their mortgage software, changing services are at the top of record.

Missing Expenses Money

Their payment records usually is the reason thirty-five% of your own overall credit history. It means even that late percentage is sufficient to bring your get off because of the fifty affairs or more enough to cost you the home you want.

Lenders pay close attention to the financing an incredible number of individuals. Run improving your rating and you may maintaining it before you apply for your financing.

And come up with Significant Orders

To find a car or truck, a refrigerator or one major product isn’t the most readily useful flow before you apply to own home financing. Which have genuine deals is amongst the very first one thing lenders want from borrowers and you may and come up with a primary buy can cut to your money on hands. Taking right out a loan or using your credit card making a purchase was an even bigger red-flag to a lender.

Stacking Right up Expenses

Using up numerous bills before applying getting a home loan have a tendency to enhance your personal debt-to-earnings ratio, that is your own overall personal debt, such as the prospective home loan, split up from the just how much you earn per year. The greater this new DTI, the reduced your odds of a loan provider giving the loan.

If you have a great DTI away from 6 or higher total obligations at least half dozen times their annual money lenders will envision your a dangerous debtor.

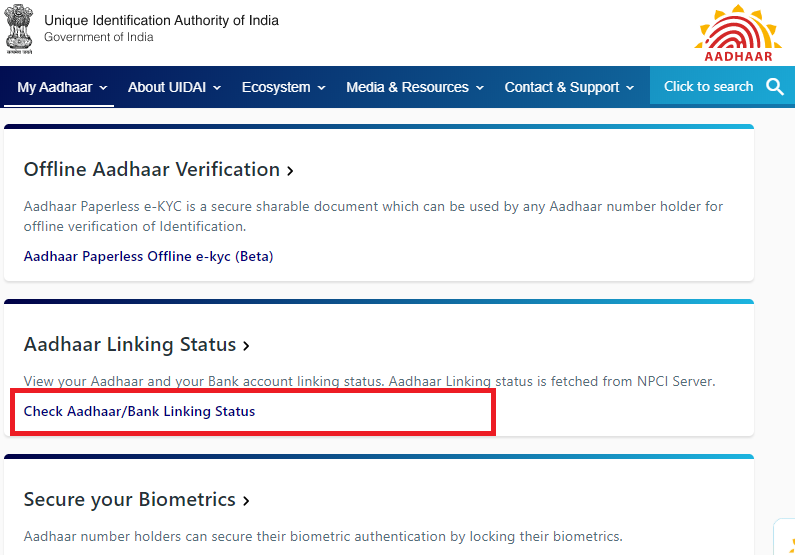

Closing Off A charge card Membership

In lots of things, closure a card-cards account is a sensible flow not when you really need to apply for home financing.

If you get rid of credit cards, your amount of offered borrowing from the bank try faster. This will hurt your credit score, as your obligations-to-borrowing proportion you will definitely increase. Specifically if you have a huge credit card debt, closure the fresh new account doesn’t help your credit rating but will bring it off as an alternative.

Agreeing So you’re able to Co-Sign up That loan

When you co-signal, your invest in feel partially responsible for your debt new borrower is liable to blow. It means a huge drop in your credit score when they try not to create the individuals payments on time.

In the event that you Stick to You to Financial While deciding Making an application for An excellent Mortgage?

It might seem better to stick to you to lender and lookup what they choose and you may whatever they you should never. not, this should confine one one lender’s rules.

As an alternative, read more lenders’ rules, research your options, find the best interest rate it is possible to and make certain to select the offer that fits their mortgage needs a knowledgeable.

The following is in which a specialist mortgage broker comes in helpful. Home loan Positives provides fifty+ lenders in committee, which you’ll browse before applying.

Your own broker will guarantee your use towards financial where there is the most useful opportunity from the effective acceptance for your house loan places Sterling Ranch loan.

Should you Apply for Pre-Recognition Basic?

Should you decide to help you winnings your dream possessions during the an auction, you really need to get pre-acceptance on the a loan very first.

What is the Acceptance Process Which have Home loan Masters Such as for example?

- Complete and you will indication the short application.

- Give proof your revenue, deals, and you can debts, such as for example handmade cards and other fund.

- We’re going to done a short testing and you may suggest several suitable loan providers and you will fund.

- We’re going to lodge the job towards the lender you have chosen.

- The lender have a tendency to done an assessment of disease and gives pre-recognition.

Away from rooms their pre-acceptance application to working for you find a very good rates, Home loan Professionals will perform everything. Realize our very own detail by detail page towards financial pre-recognition to get more insights exactly how the process is different while in the COVID-19 constraints.

Keep in touch with An expert

Home loan Masters helps you pick the proper loan choice and you may have a look at your house loan condition to find the best possible lead. Contact us with the 1300 889 743 otherwise submit our very own free online inquiry function.